Table of Contents

Introduction

Bank Predictions

Recent Mortgage Cuts

RBNZ New Mortgage Restrictions

Increase in House Listings

Inflation Rate in New Zealand

FAQ

January 2024 marked the beginning of the year with notable developments in the Christchurch Property Market. Nationally, there was a 10% year-on-year increase in house listings, the Reserve Bank of New Zealand (RBNZ) introduced new restrictions and the inflation rate reached its lowest point since the start of 2021.

This article explores the motives guiding the real estate predictions of banks, the impact of mortgage cuts, the consequences of the newly imposed RBNZ restrictions, and the significance of the declining inflation rate. As the market experiences shifts in 2024, it is imperative not to be swayed by optimistic forecasts and to approach the property market with a measured mindset.

All Banks are businesses that rely on people borrowing money from them. By making positive predictions about the property market, they aim to create a sense of urgency and encourage potential buyers to take action. Similarly, a recent article on bank predictions for 2024 NZ house prices was revealed. Every New Zealand bank is predicting an increase in house prices this year, but are they correct?

Major banks like ASB predicted a 2.5% growth while Westpac gave an optimistic prediction forecasting a 7.7% growth in real estate prices for New Zealand. While this may sound promising, it's important to remember that these predictions are designed to encourage borrowing.

At Najib, we believe the market isn’t as bullish as the banks are predicting, you can read our full article on our thoughts here: 2024 House Price Predictions.

Have you wondered with inflation so high, why banks are lowering interest rates at such a small percentage?

The truth is when the economy is struggling, banks are competing for your business. These minimal mortgage cuts aim to attract business away from other banks and encourage potential buyers to take action. At Najib, we don’t see these small drops in interest rates having a significant impact on the overall market.

Interest rates only move when the Reserve Bank changes them. So, while banks may make slight adjustments to their rates, the larger movements are determined by the Reserve Bank's decisions.

The primary goal of banks is to generate profits, and by offering lower interest rates, they hope to secure more customers and increase their business. These cuts are part of their strategy to compete with other banks and attract borrowers in a tougher economy.

Furthermore, it's important to remember that the real estate property market is influenced by various factors, including supply and demand dynamics, economic conditions, and government regulations. These factors play a significant role in shaping the market and should be considered when assessing the potential impact of mortgage cuts.

New Restrictions coming into play mid 2024

The Reserve Bank of New Zealand (RBNZ) recently introduced new mortgage restrictions to ensure financial stability in the New Zealand property market. These restrictions, outlined in an article by the RBNZ, are designed to limit the amount of debt borrowers can take on relative to their income.

The article explains that these income-based mortgage restrictions support financial stability by reducing the risk of a future financial crisis. By limiting higher-risk mortgage lending, the RBNZ aims to prevent another housing crisis and keep the market slow.

Here’s the break down of the new mortgage restrictions proposal;

Owner-occupiers: No more than 20 per cent of the value of the mortgages they issue can go to borrowers seeking debt worth more than six times their gross annual incomes.

Investors: No more than 20 percent of mortgages go to borrowers seeking debt worth more than seven times their incomes.

The new mortgage restrictions set limits on the amount of debt borrowers can take on relative to their income. This means that borrowers will have to meet stricter affordability requirements when applying for a mortgage. The goal is to ensure that borrowers are not taking on excessive levels of debt that they may struggle to repay.

The purpose of these restrictions is to maintain financial stability in the property market. By limiting higher-risk mortgage lending, the RBNZ aims to reduce the likelihood of a future financial crisis and another property boom we experienced in 2021. The restrictions are part of a broader strategy to keep the market slow and prevent it from taking off too quickly.

These mortgage restrictions are one of the measures implemented by the RBNZ to slow down the property market. By making it harder for borrowers to take on large amounts of debt, the restrictions reduce the demand for properties. When demand decreases, the market softens, and property prices are less likely to experience rapid growth.

In January the property market saw an increase in house listings on Trade Me, indicating a rise in supply. This increase in supply has important implications for the market and potential buyers.

By examining the number of listings, we can gauge the level of competition among sellers. More listings mean more options for buyers to choose from, leading to a softer market.

The impact of increased supply on the market is significant. With more houses available, buyers have more bargaining power and can negotiate better prices. This can lead to a decrease in property prices, offering potential buyers a favourable opportunity to purchase a property.

Understanding the relationship between supply and demand is crucial in assessing market conditions. When supply outweighs demand, prices tend to decrease. Conversely, when demand exceeds supply, prices typically increase.

That’s why we suggest assessing a specific suburb for more accurate data than the whole market.

For instance, comparing prices within specific areas suburbs in Christchurch can give a more accurate picture of how the market is behaving. By analysing price movements in these smaller areas, buyers can identify potential opportunities and trends.

We sell a lot of properties within the Selwyn area, particular West Melton. We recently sold a residential section in West Melton last week for $430,000, a similar section last year went for $677,50. This is a 35% drop giving you an accurate picture of the market when focusing on a smaller sample size.

The current inflation rate in New Zealand has been decreasing in recent quarters, dropping to 4.7% this year, compared to the previous quarter at 5.6%. While a lower inflation rate may initially seem positive, it can indicate a slowdown in the economy. It's important to understand the implications of lower inflation and its link to the overall economy.

Lower inflation can lead to various effects, including higher unemployment rates and decreased economic activity. This is because lower inflation often reflects a decrease in consumer spending, which can result in businesses cutting costs, reducing their workforce, and slowing down their operations.

This is further impacted by National’s removal of the RBNZ’s current dual policy mandate of price stability and employment. With National returning the Reserve Bank of New Zealand to having a sole focus on inflation. This means that their primary goal is to control inflation and ensure that prices return to normality.

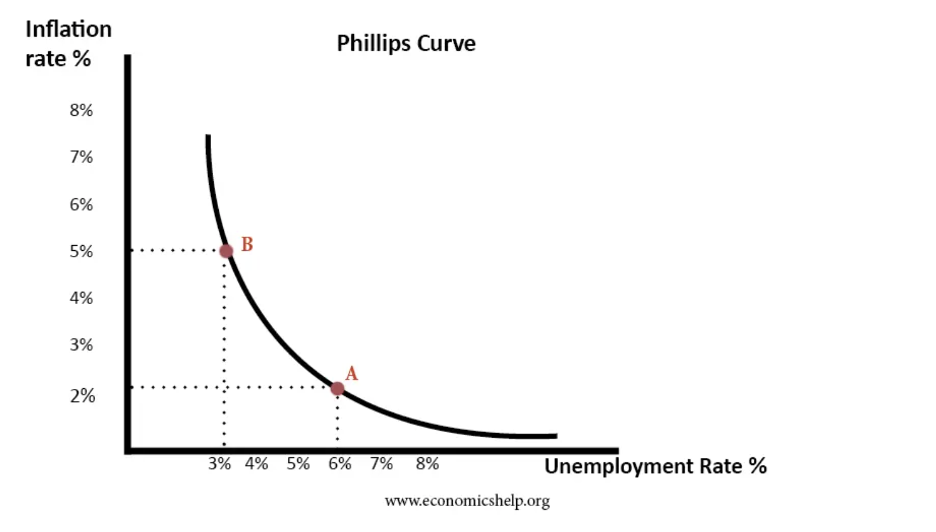

One way to understand the link between inflation and the overall economy is through the Phillips curve. The Phillips curve illustrates the relationship between inflation and unemployment. When inflation is high, unemployment tends to be low, and vice versa. This means that when inflation is low, there is a higher likelihood of higher unemployment rates.

Incase you missed our previous article check it out here: 2024 House Prices Predictions & Insights.

While the 2024 market brings forth promising predictions and shifts, it's important for us not to get into the trap of quick wins and to approach market shifts cautiously.

The RBNZ are doing their part in lowering inflation rates to help stabilise the economy. As the economy adjusts and finds a balance, inflation rates may fluctuate, and it's crucial to monitor these changes and their potential impact on the property market.

Stay tuned to our next update and if you have any questions feel free to reach out to us at info@najibre.co.nz

What are the key factors influencing the Christchurch property market?

The key factors influencing the Christchurch property market include bank predictions, mortgage cuts, RBNZ mortgage restrictions, house listings, and the inflation rate. These factors can impact supply, demand, and overall market trends.

How do mortgage cuts affect property prices?

Mortgage cuts can potentially increase demand in the Christchurch property market. When banks lower their interest rates, borrowing becomes more affordable, and buyers are more inclined to take out mortgages to purchase properties. This increased borrowing can lead to higher demand and potentially drive up property prices.

To help combat this the RBNZ has introduced DTI restrictions to prevent market from increasing rapidly.

What impact do the RBNZ mortgage restrictions have on the economy?

The RBNZ mortgage restrictions are in place to ensure financial stability in the Christchurch property market. These restrictions limit the amount of debt borrowers can take on relative to their income, reducing the risk of a future financial crisis. The restrictions contribute to a slower market and help prevent another housing crisis.

Why is the increase in house listings significant?

An increase in house listings indicates a rise in supply in the Christchurch property market. When buyers have more options to choose from, the market softens, giving buyers more bargaining power and potentially leading to lower property prices. Monitoring house listings provides valuable insights into market conditions and trends.

What are the potential consequences of lower inflation?

Lower inflation rates can indicate a slowdown in the economy. This can lead to higher unemployment rates, decreased economic activity, and reduced consumer spending. However, lower inflation rates may also be temporary and part of the process of stabilising and growing the economy. It's important to monitor inflation changes and their potential impact on the property market.