With the housing market on a run-away trend it can be difficult to know where to invest and if it’s the right time to do so. Interestingly, Christchurch is often overlooked as an investment opportunity. However, this growing city offers an affordable cost of living, and the opportunities it is now providing are becoming more appealing to buyers and investors from both Christchurch and nationwide.

The median house sale price in New Zealand has increased significantly in the last twelve months. In fact, in October, we witnessed the median house sale price in Auckland reaching a record $1.2 Million. Whereas, Christchurch remains the most affordable major city to buy in, with the median house sale price only $510,000. One could say that Christchurch is, in fact, an investor’s dream.

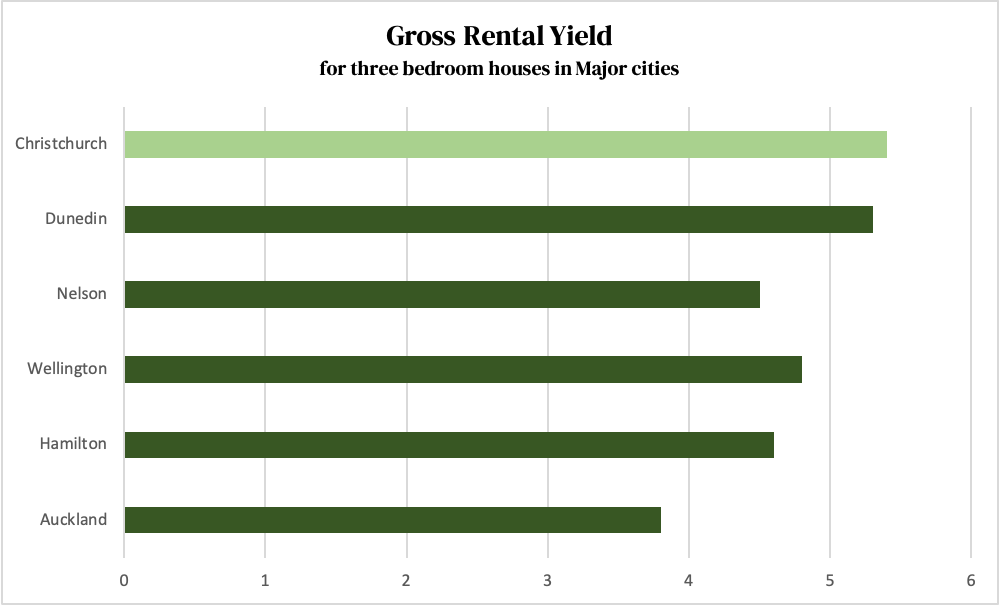

Property investment in the Christchurch region quickly becomes the smart choice, as the more affordable the investment, the higher the yield. Christchurch is the country’s leader in yield at 5.4%. Demand for Christchurch rental properties is on the rise, and the median weekly rent is currently $485, having increased by 1.2% in the last year alone.

When investing in rental property, you will likely be considering your options in terms of capital gain and/or yield. Some areas of Christchurch, for instance, will return higher yield, whereas, other will have a higher capital gain value.

Potential investors in it for the long run and interested in both capital growth and yield should consider purchasing in the city centre or Rolleston, with both experiencing impressive growth and interest due to further council investment in infrastructure and community developments.

Suburbs that cater to first home buyers have the highest rental yield as they are more affordable investments. Nathan Najib recommends a short-term strategy, with a focus on yield, would mean centring your search around the eastern suburbs is a smart decision as these east-side suburbs have short term growth and a yield of 5.8%.

Another factor to consider when looking for an investment property is good school zoning, as this will always positively influence a property's capital growth. With this is mind, particular Christchurch suburbs for investment properties to pay attention are Avonhead, Burnside, Riccarton, Spreydon and Sommerfield.

The area that is right for you depends on your investment strategy – short term or long term. If you’re looking to invest in the property market, Christchurch is the place to pick. For more information, help or advice about investing in Christchurch, please get in contact with Sha or the Najib sales team and we would be happy to help guide you to the right direction.