As the year draws to an end, I find myself reflecting on all that we have been through this past year. No one saw 2020 coming, and while the months have blended together and the year quickly past, this year is one that will be well remembered. Two lockdowns later and despite all the fears of the New Zealand property market crashing following covid-19, our market is more active than ever before and in line with my March predictions.

There are a number of factors that come into play when determining the marketplace and predicting future changes which are the average home price, the number of annual home sales, the supply of inventory, interest rate fluctuations, and affordability.

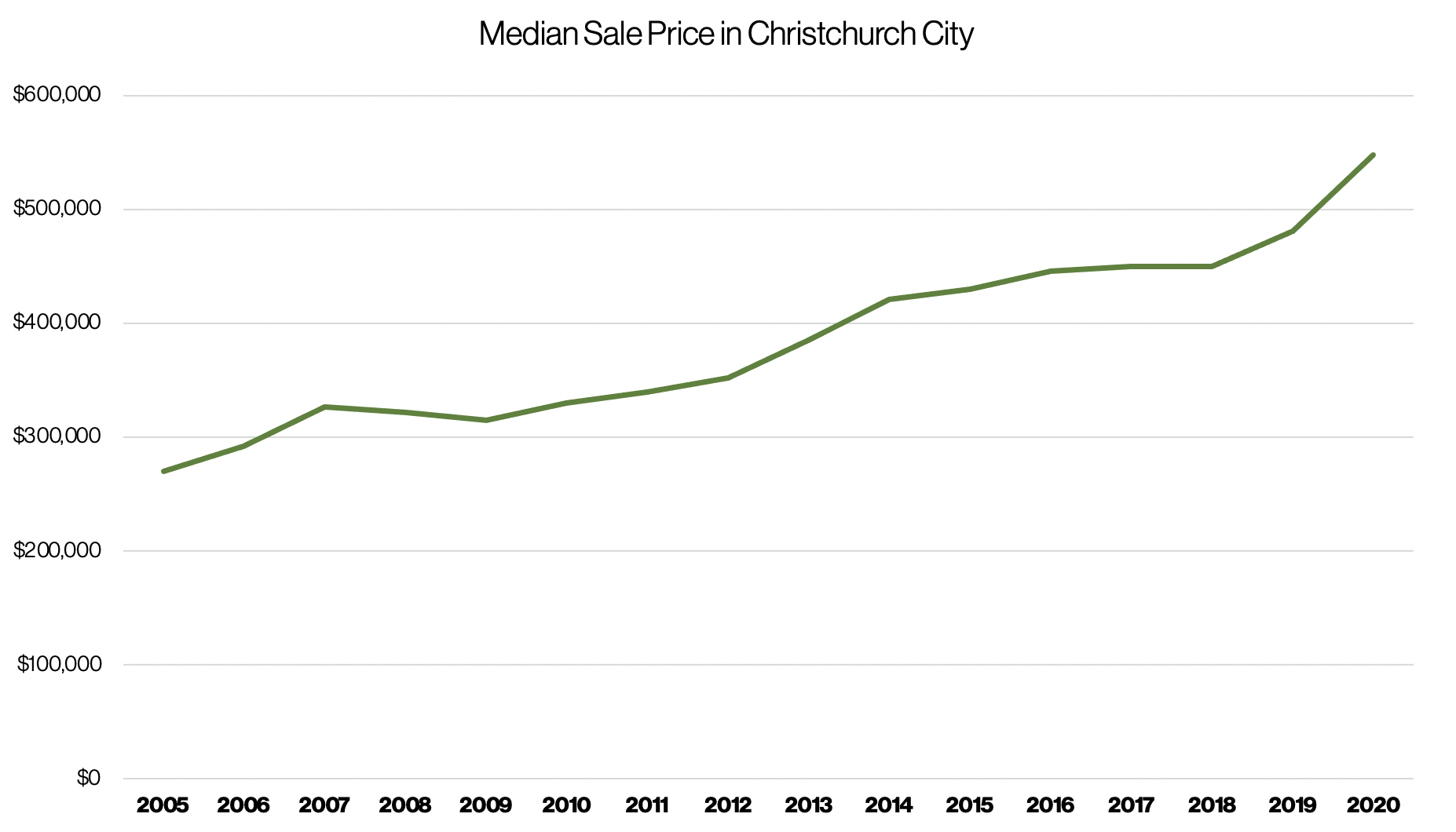

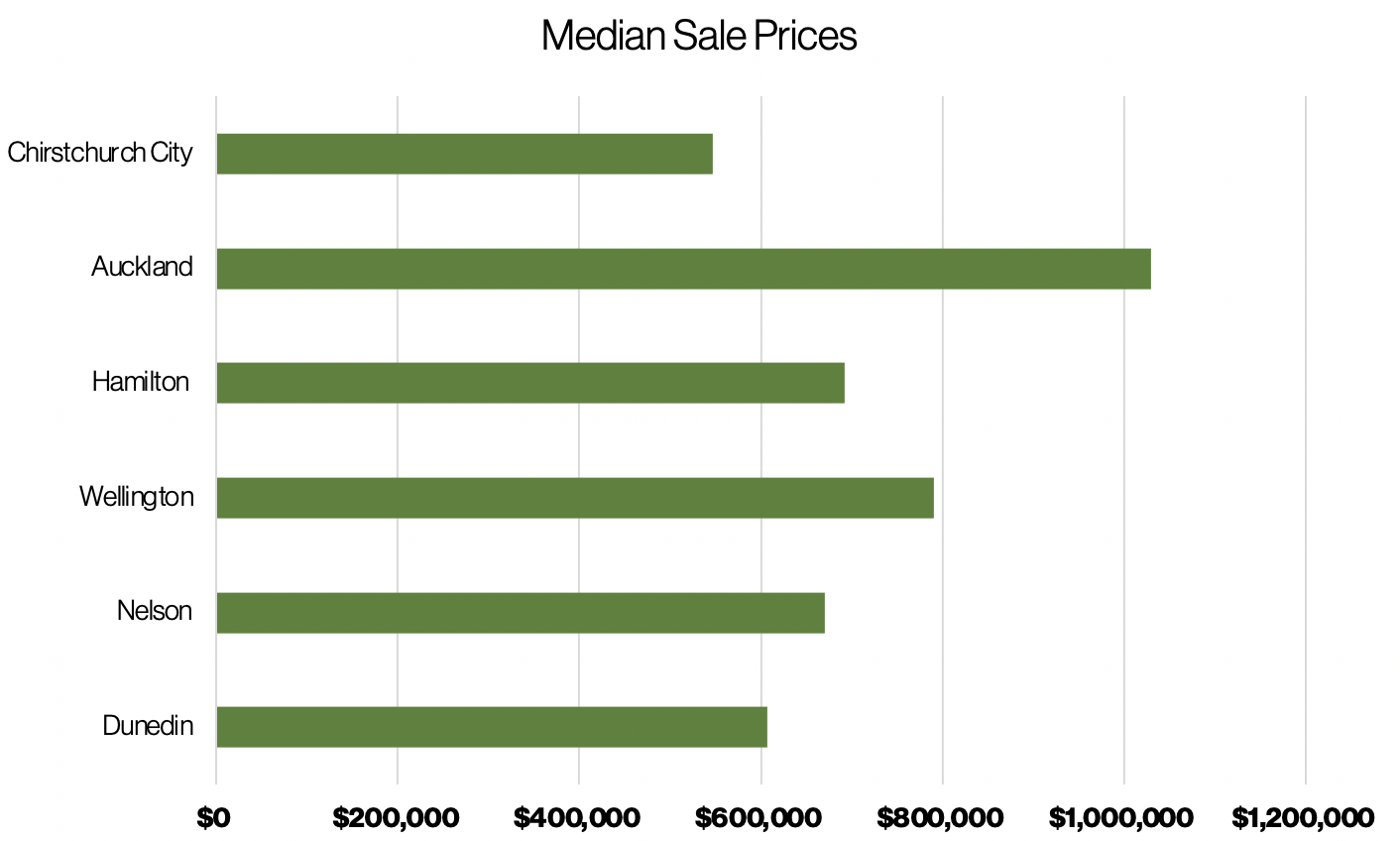

Sale Price

This November, Christchurch City has again reached record high sale prices, with the median sale price now $547,500. Year on year, this means the median sale price in Canterbury is up by 13.1%. A healthy growth rate is anything up to 4%, meaning this current market is not sustainable or ideal for the long term.

It is unlikely that Christchurch’s sale prices will fall, as historically this has only occurred once in the last 15 years. I do believe, however, that the increase in sale prices will slow as the other variables begin to change.

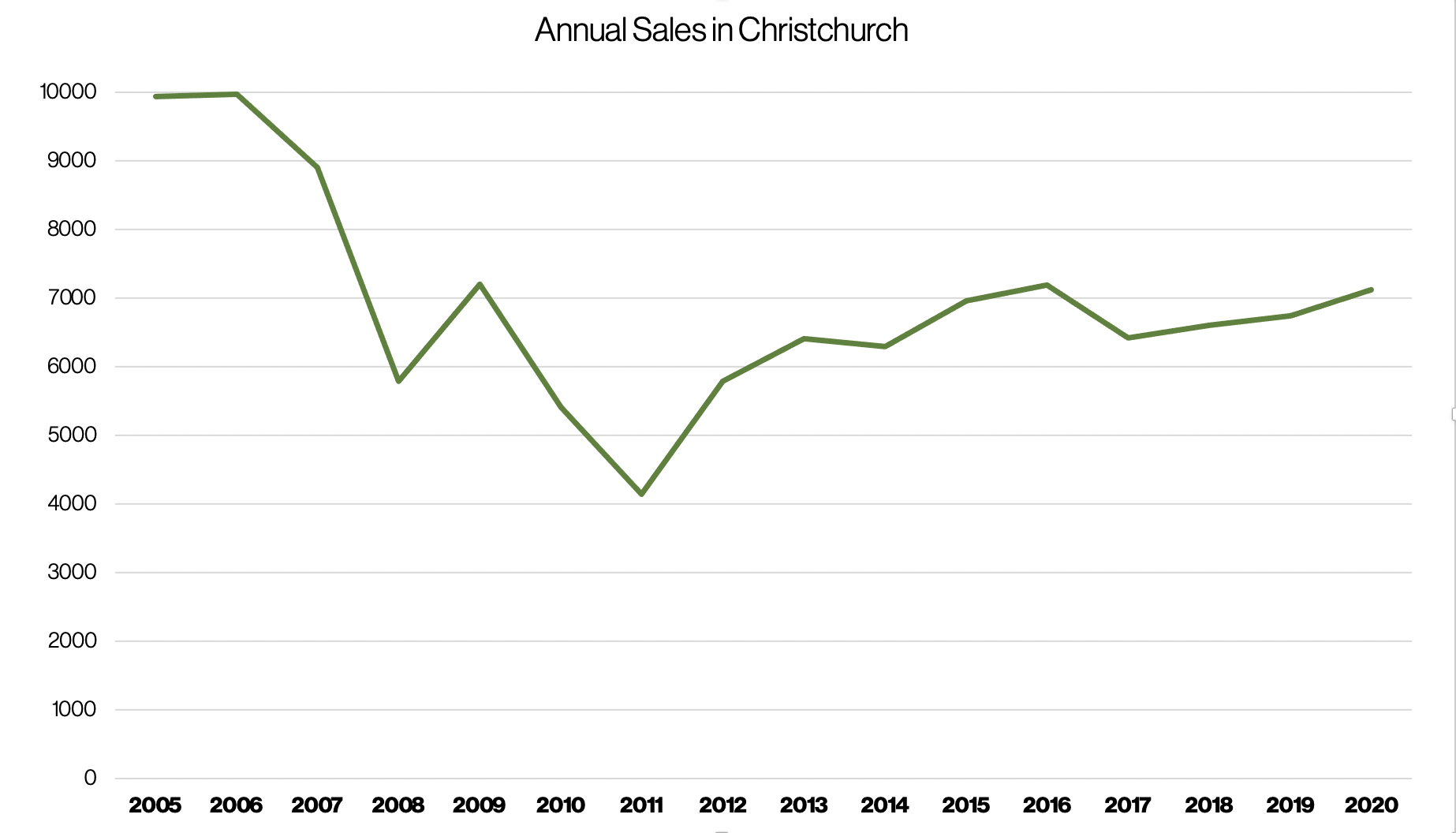

Annual Sales

Christchurch has also seen a 5% increase in annual house sales, with 7,127 homes being sold in the past year. This is quite outstanding given that the New Zealand property market paused momentarily during the lockdown period.

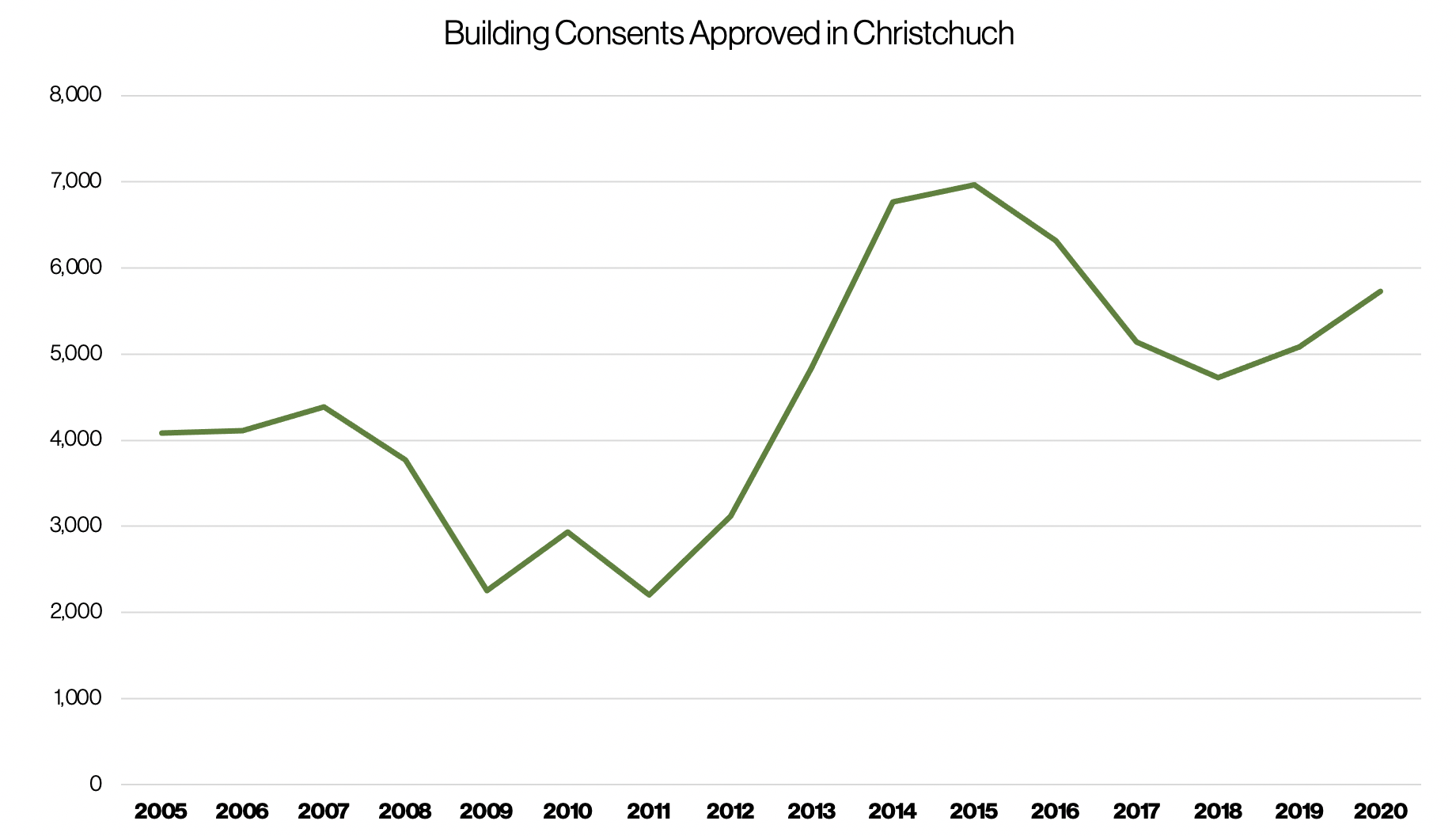

Supply of Inventory

It is well known that New Zealand is facing a housing crisis, with this being a large driving factor in the unaffordability of the New Zealand property market. Christchurch has more supply than most major cities, with the Canterbury plains offering land for development and the opportunity for growth in size. The city’s adaptability has resulted in Christchurch being the country’s most affordable major city, with this affordability attracting returning expats and New Zealanders alike. With an influx of buyers, Christchurch has found itself in the middle of a buyer frenzy.

When driving around the outskirts of Christchurch, new sites for houses and suburbs can be easily found. It seems like a new development is popping up every second week. This is because developers buy when the market is hot, as they know when there is excess demand, new builds will quickly sell. In the last year 5,729 buildings in Christchurch have been consented. I believe this upward trend will continue, and as it does the Christchurch property market will begin to slow, with the new developments relieving some of the stress on the market.

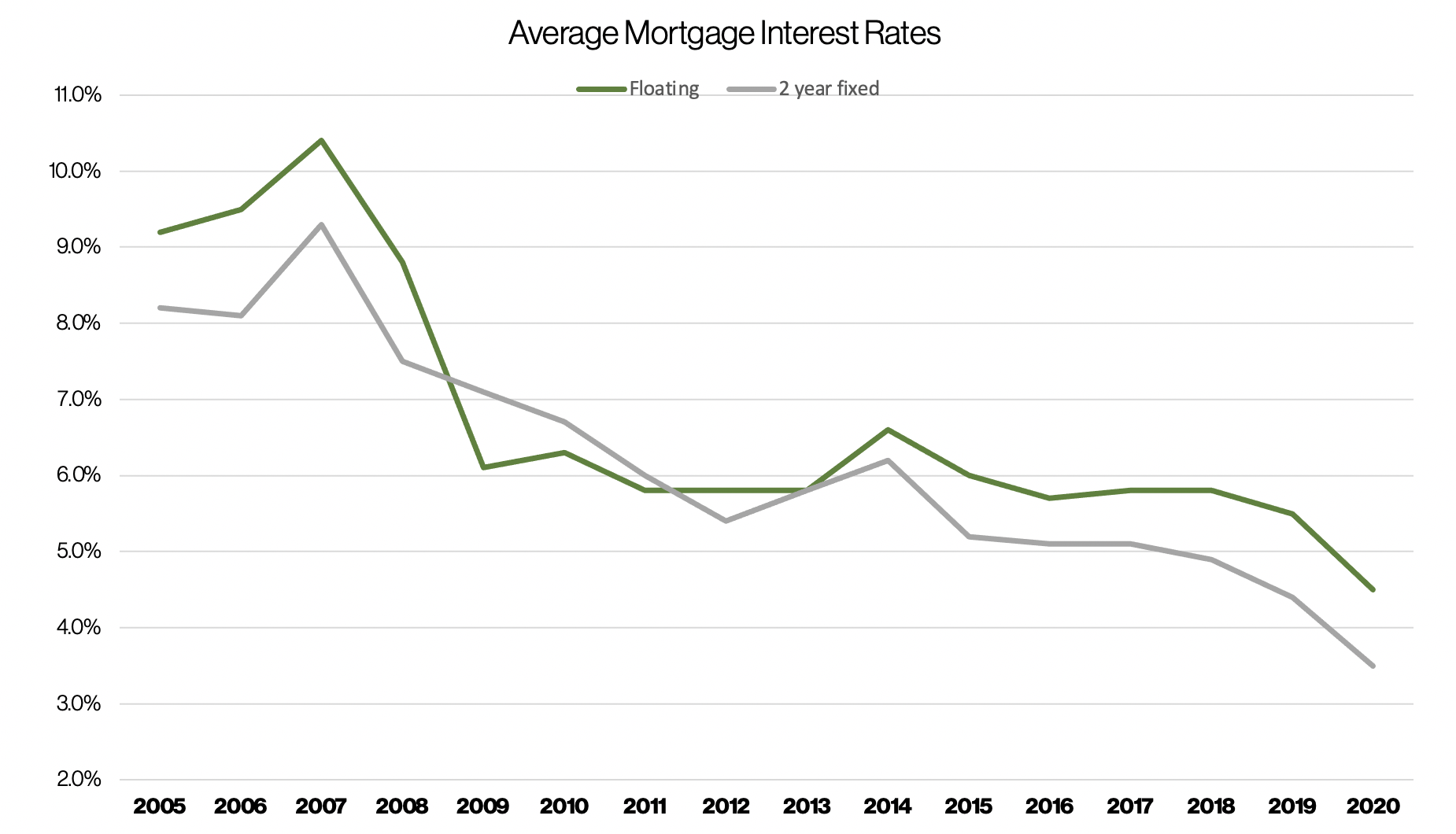

Mortgage Interest Rate fluctuations

Mortgage interest rates are considerably low with a current floating interest rate of 4.51%, and a fixed interest rate of 3.5%. This is opposed to the floating interest rate in November 2019 of 5.45% and fixed rate of 4.4%. These low interest rates aid buyer affordability, creating a bigger market looking to buy. As the number of first-time buyers increases, the market begins to see a knock-on effect, with owners now looking to climb the property ladder. The influx of first-time buyers and its knock-on effects puts more stress on supply and demand, and has boosted the sale prices this past year.

Mortgage interest rates are always going to fluctuate. However, I predict that while the rates may bounce slightly, they will stay low for the next few years.

Affordability

Christchurch is the most affordable major city to buy in, and due to this, it is also home to the one of the largest rental yields in New Zealand. Now is the time to sell in Christchurch with the sale prices at an all-time high, yet one that is unsustainable in the long term. As the city’s stock continues to increase and interest rates slowly rise, the buyer pool will get smaller, lowering demand and slowing the huge and unsustainable jump in Christchurch’s sale prices.

I predict that the market will start to steady mid 2021 and the Christchurch property market will return to a sustainable level of growth. Have a happy holiday season, and if you would like to know more about the market, myself or the Najib team would be happy to help.