If you’re thinking about buying a house in NZ in 2026, it’s important to look beyond the headlines. Property markets don’t move on emotion alone — they move on data. Supply, demand, interest rates, and policy decisions all work together, and when these factors align, real opportunities appear.

In the first Real Talk IN video of 2026, real estate agent and market analyst Nathan Najib explains what’s really happening in the New Zealand housing market, why buyers now have more leverage, and what sellers must do differently in a buyer-led environment.

This article breaks down those insights using real data from REINZ and realestate.co.nz, helping buyers, sellers, and investors make informed decisions in 2026.

NZ House prices are heavily influenced by the balance between housing supply and buyer demand.

Between 2018 and 2021, New Zealand experienced a perfect storm:

Demand surged

Supply couldn’t keep upInterest rates fell to record lows

The result was rapid, unsustainable price growth.

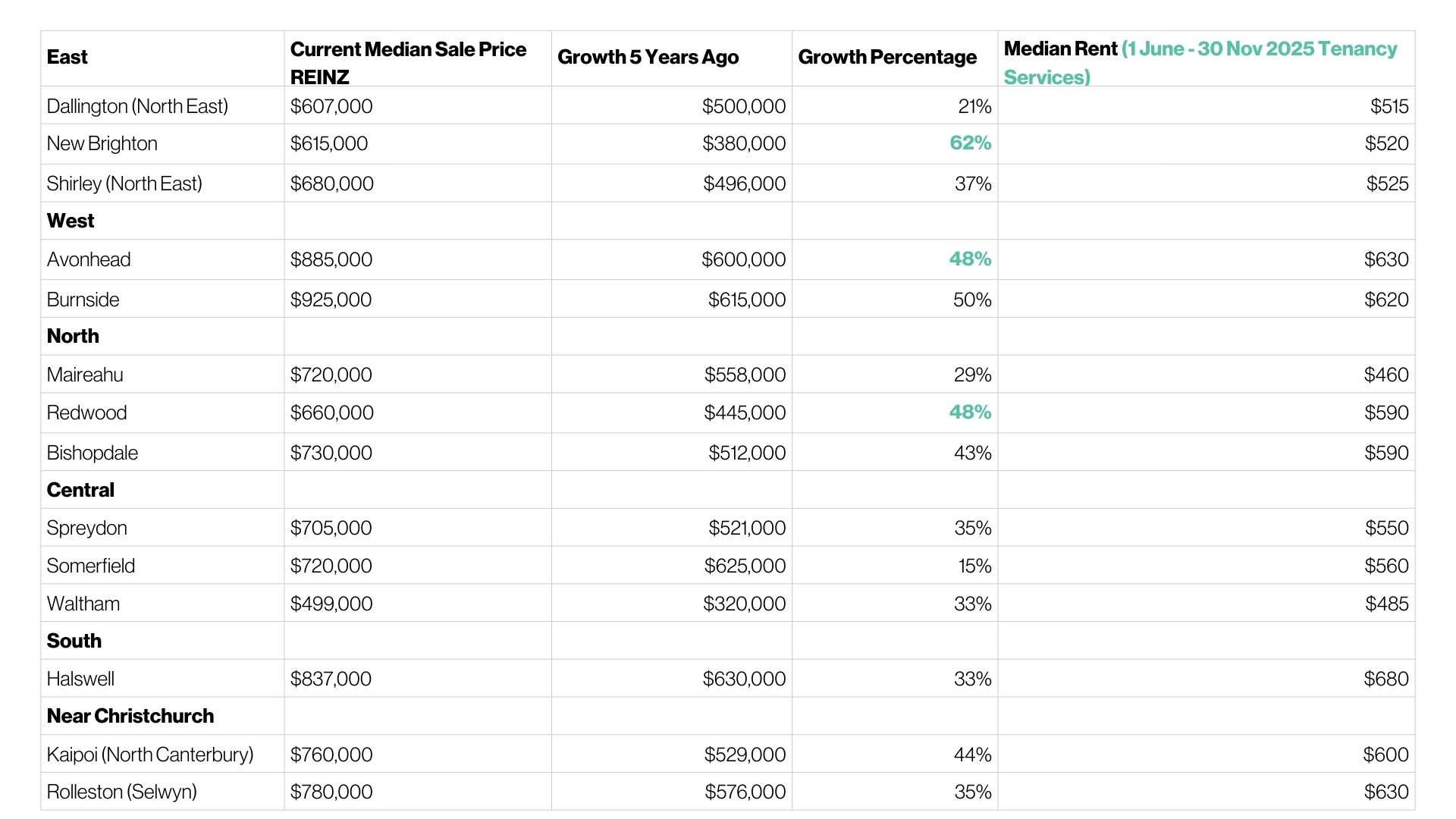

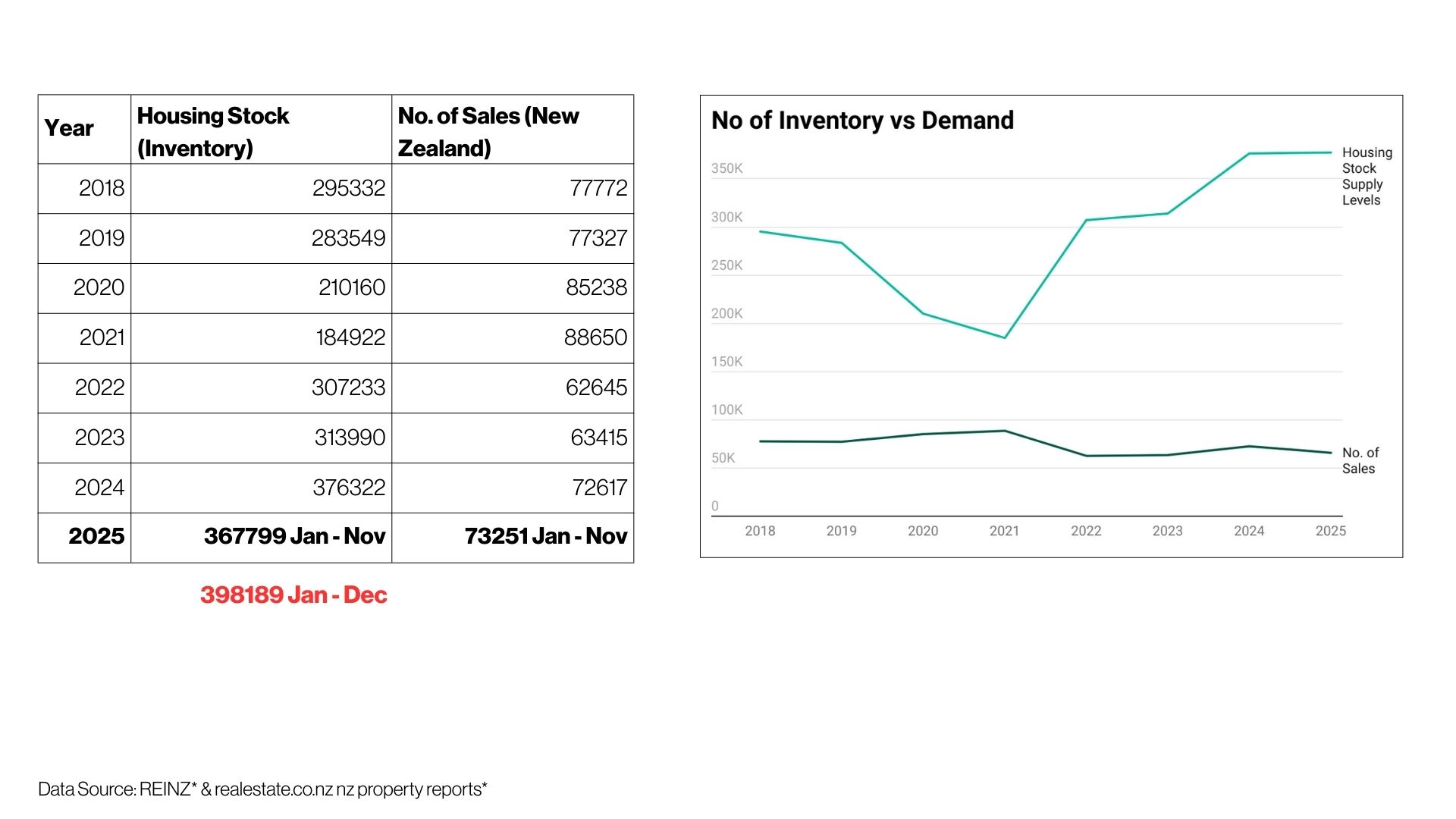

What the Data Shows (2018–2025)

2018–2019: Market largely balanced

2020–2021: Demand spiked, supply tightened

2022–2024: Supply increased, demand cooled

2025: Supply clearly outpaced demand

By January–November 2025, there were approximately 367,799 properties listed nationwide, with 73,251 sales. Including December, total housing stock approached 398,000 properties, one of the highest levels seen in years.

This surplus of stock explains why prices haven’t surged, even as interest rates eased.

Lower interest rates don’t automatically mean higher house prices. That only happens when supply is limited.

In 2020–2021:

This balance is intentional. Policymakers are aiming for affordability and stability, not another boom. As a result, demand is being absorbed without pushing prices sharply higher.

This is why buying a house in NZ in 2026 looks very different from buying in 2021.

1. More Choice

High stock levels mean buyers are no longer competing for limited properties. If one home doesn’t suit, there are alternatives.

2. Stronger Negotiation Power

When supply outweighs demand:

3. Fewer Panic Decisions

FOMO has largely disappeared. Buyers can take their time, complete due diligence, and make better long-term decisions.

4. Smarter Long-Term Buying

Rather than overpaying at the peak, buyers in 2026 can position themselves for steady, sustainable growth.

Buyers are active, but not at levels that overwhelm supply.

What This Means for Sellers in 2026

While it’s a buyer’s market, good homes still sell well. Sellers simply need to adapt.